Collapsing Sliding Windows: A Strategic Planning Framework for Uncertain Events

Discover how Collapsing Sliding Windows (CSWs) help leaders anticipate and respond to uncertain future events.

Introduction

Effective agile planning processes strive to balance the forecasting and planning of future events with ensuring organizations can deal with uncertainties as new information comes to light. For many people, the responses to these events are well established. When they are imminent but responding to them only requires a modest investment, leaders capture them in roadmaps and handle them through everyday development practices. When they are imminent and responding to them requires a more significant investment, leaders handle them through a combination of development- and portfolio-management practices.

These strategies are usually adequate under normal circumstances. But they have serious drawbacks when it comes to reliably anticipating, planning for, and managing events that are likely to occur outside of conventional planning-time horizons. Nor are these strategies sufficient for managing events whose timing is difficult to pin down because many of events are subjective and likely to be associated with complex factors, and/or whose outcomes can be dramatically improved through a consistent set of low-cost prior actions.

Fortunately, there are planning techniques that can help organizations position themselves to reduce unnecessary downside costs and improve their chances of realizing any potential upside during uncertain event time horizons. These techniques give leaders the tools they need to be more planful about how they allocate their efforts and resources, helping them set up their organizations to best benefit from events, regardless of how fluid their timing is.

This paper introduces a new planning construct, Collapsing Sliding Windows (or CSW), that fills a critical gap in how organizations can prepare for events that may occur beyond one to three years, the time horizon that organizations that want to embrace agility and/or Lean development practices typically plan for.

CSW is a probabilistic planning construct that represents a bounded time range during which an uncertain future event is likely to occur, along with a probability density over that range. The “collapsing” refers to a contraction in opportunity space—an area where proactive options diminish as time progresses without action. The “sliding” refers to shifts in the window’s position in time.

By better understanding the characteristics of these events and the dynamic nature of Collapsing Sliding Windows, business leaders can improve their strategic planning, prioritization capabilities, and emergency response preparedness while more prudently managing resources to achieve better, more predictable outcomes. Conversely, failing to leverage Collapsing Sliding Windows may precipitate overly reactive and potentially costly interventions, as organizations and individuals lose valuable options and find themselves scrambling to respond to events with diminished confidence and increased costs.

Throughout this paper we provide numerous examples of Collapsing Sliding Windows in action, and show how developing Proactive Action Strategies (PAS) and Proactive Action Plans (PAP) gives leaders more control over their future.

Dissecting “Future Events”

Before we continue, let’s briefly review what we mean by future events.

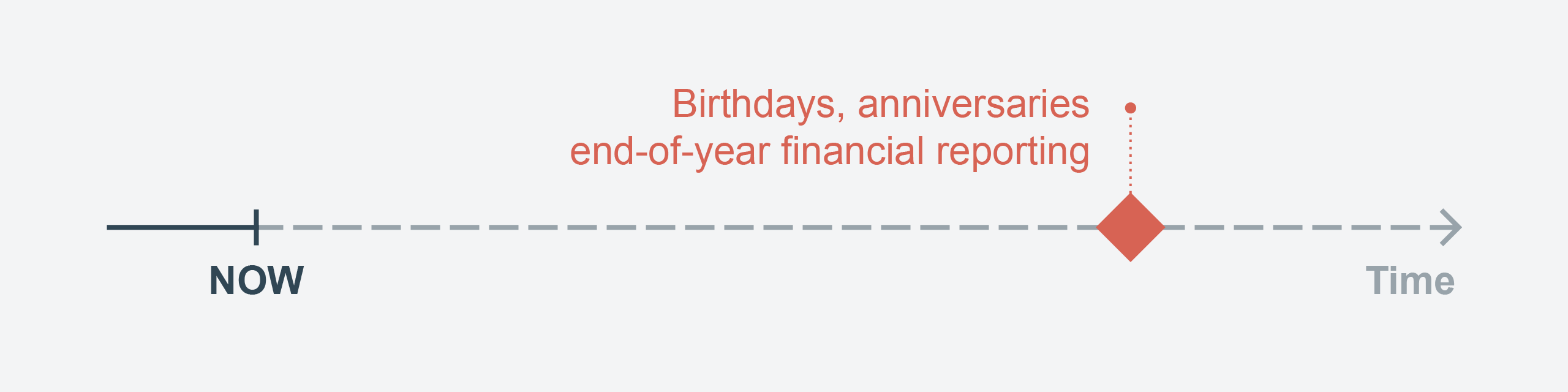

An event is typically associated with a date, and the date of many future events is known with absolute certainty. Examples include birthdays, anniversaries, weddings, quarterly or end-of-year financial reporting, the closing date of a material financial transaction, or a new regulation impacting a business. These dates, whether recurring or non-recurring, form the basis of our planning.

Of course, the events we care about may not be associated with the date. We may care more about the act of celebrating a birthday or anniversary rather than the date each occurred on, and when these dates fall on a weekday, we may schedule a party for the weekend before or after. This decoupled and adjusted date is, therefore, more meaningful than the actual date of the event.

While the dates events may be set, the occurrence of the events is probabilistic. You may be entirely confident that you will attend your next birthday or anniversary. However, if we forecast far enough into the future, your confidence will start to wane: will you be alive at age 80? 90? 100?

Our point is that even seemingly certain events like birthdays, or the publication of new regulations impacting your business, have embedded probabilistic components when reframed from an actor’s perspective (actor meaning individual person).

We can illustrate this with a simple diagram. In Figure 1, for instance, dates known with certainty have been placed on a generic timeline indicating now and a later date.

Figure 1: Known Future Events

However, the date of many if not most future events are not known with such precision or certainty. Indeed, we may not even be entirely certain the event will occur at all, which makes planning for it challenging (to say the least). We need a way, then, to capture the potential occurrence of the event in such a way that we can plan for it.

This is all pretty abstract, so let’s explore it through a real-life example: retirement. Most of us think of retirement as a positive future event and, therefore, something that we want to do.

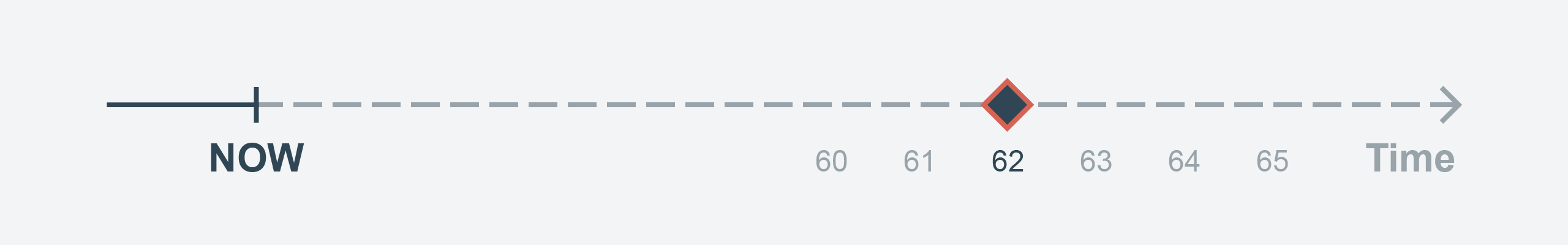

Let’s assume, then, that we want to retire at age 62. We can draw this on a timeline with a dark diamond to indicate it is a desired future event.

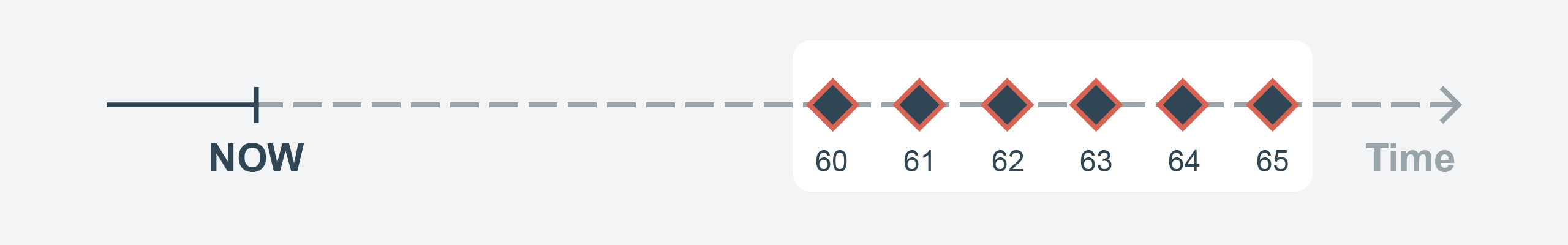

Because we don’t know if we’ll retire exactly at age 62, let’s add a few more diamonds. These capture the range of when we might retire.

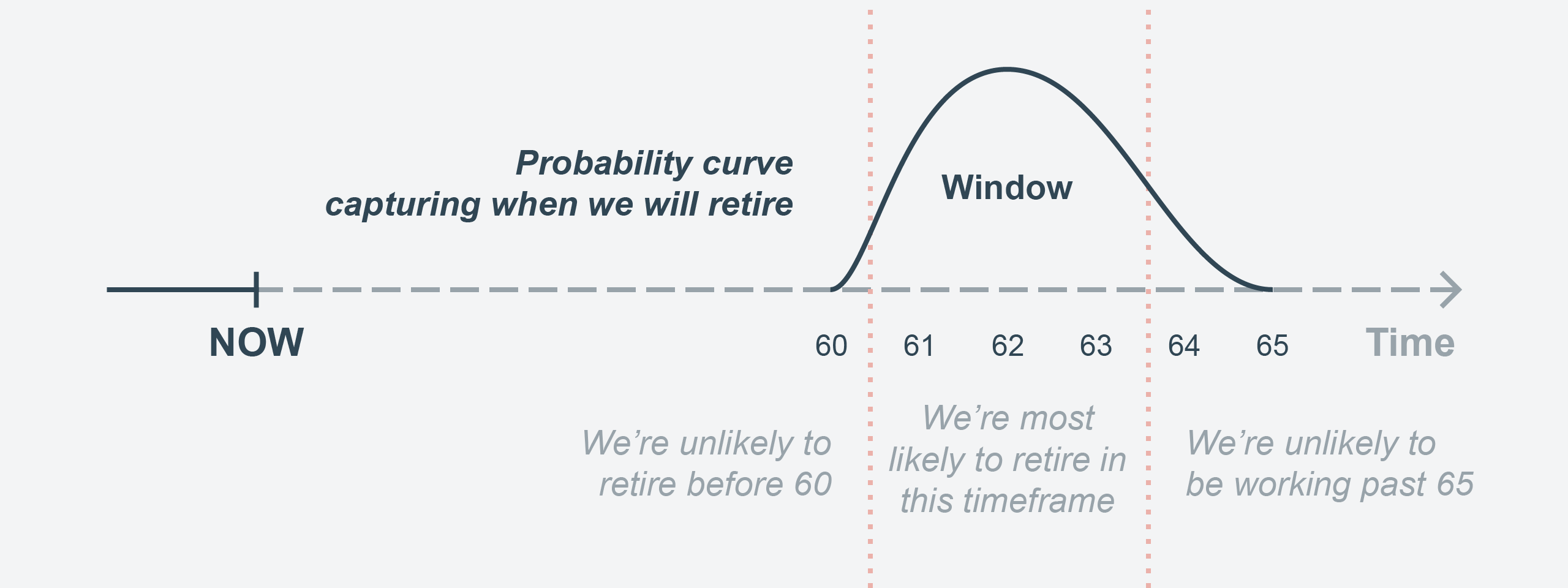

Of course, the realization of our retirement is not absolute. Instead, it is a probability based on several attributes, such as our desired lifestyle and the amount of money we believe is required to maintain this lifestyle (“a 401K with $1M in investments and a fully paid-off house”). We can capture this spectrum of possible dates in a probability density function, a curve that shows our expected retirement date (Figure 2). We refer to the timeframe we’re most likely to retire as the Window.

Figure 2: When We Will Retire

How we determine the nature of this curve varies:

- We can start with a specific target (“I want to retire at 62”) and then establish a confidence interval (“I could retire at 60, but it might take me to 63 to save enough”).

- We can start with a range of likely dates and draw a curve that covers their span.

The important point is that unless a future event is known with absolute certainty, it’s more useful to capture it in a probability curve that illustrates the time range in which we are confident the event will occur. Fortunately, the precise shape of the curve isn’t that terribly important; just drawing an approximate shape is good enough to get started.

How Windows Slide

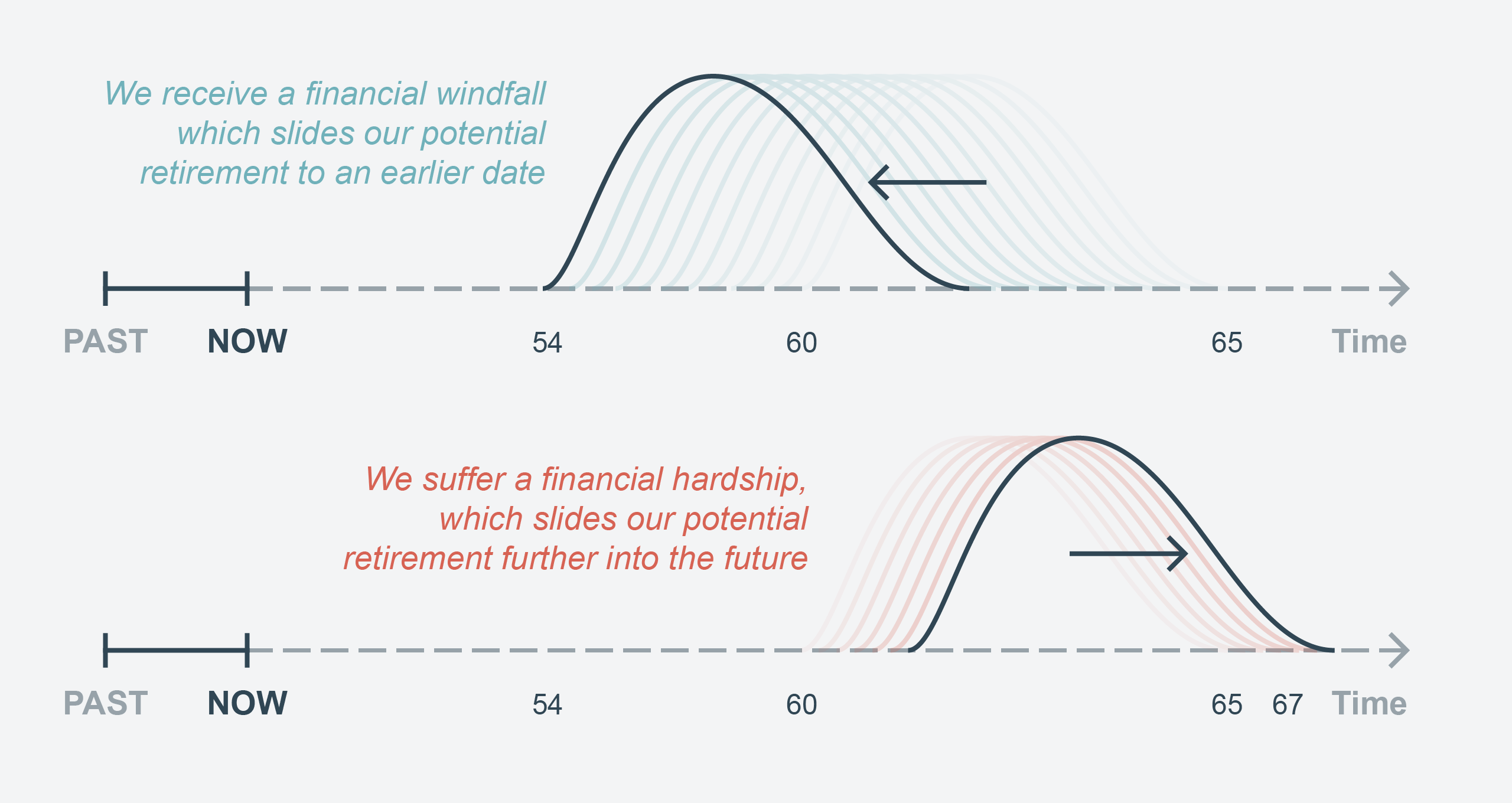

As time progresses, our actions, feelings, the macroeconomic environment, and other factors all contribute to whether we think we’re getting closer to or farther from our “retirement event.”

As shown in Figure 3, receiving a financial windfall may slide our retirement to an earlier point in time, while suffering a financial hardship such as losing a job or persistent high inflation may slide it further into the future.

Figure 3: Retiring Sooner or Later

How Wide Is a Window?

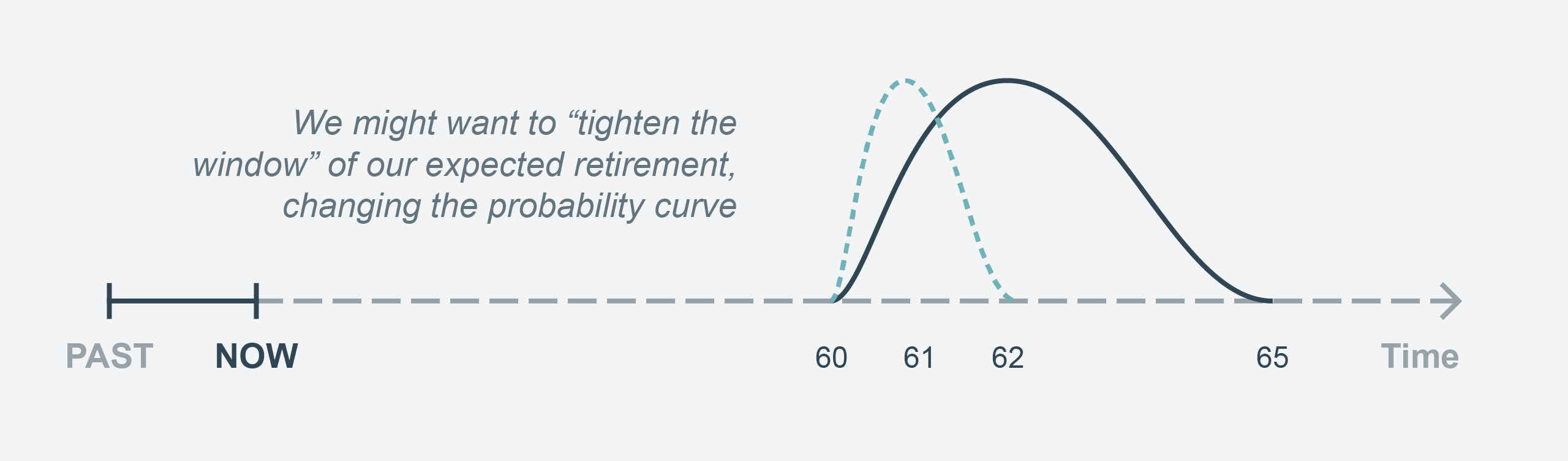

As we get closer to retirement, our retirement “number” or date becomes more precise, and we may find ourselves adjusting our expectations for how we will live in retirement to align with our present and more tightly forecasted economic circumstances, thus changing the probability curve (Figure 4):

Figure 4: Changing the Probability Curve

Note that a probability curve does not guarantee that an event will actually occur. We might, for example, die in an untimely and improbable way before our retirement, God forbid.

Objective and Subjective Events

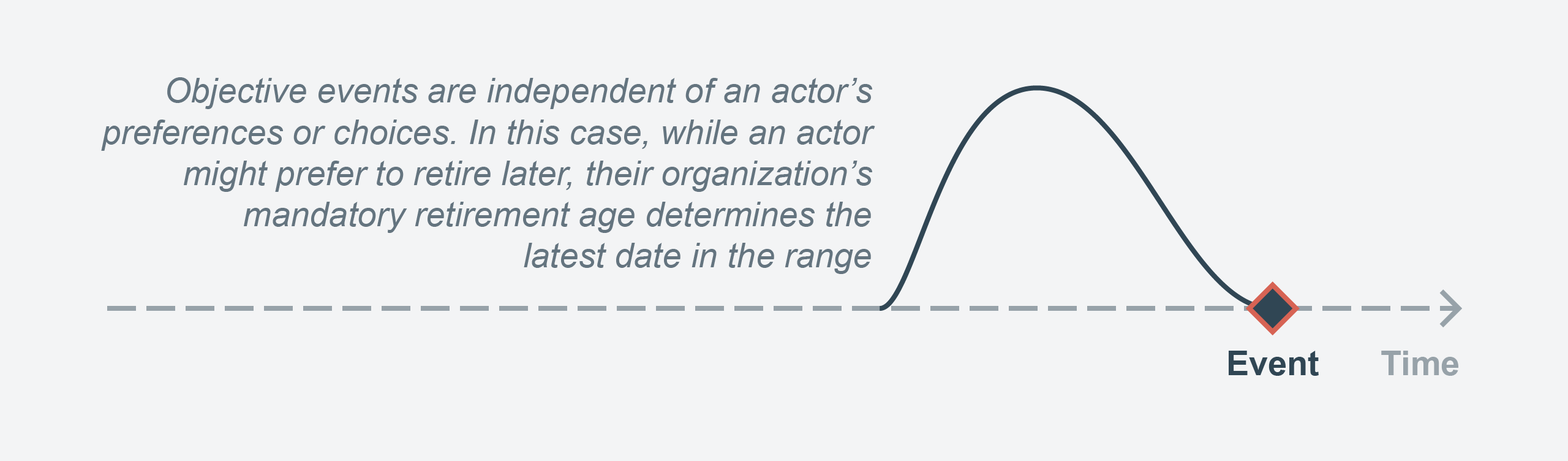

Some retirement events are objective: you reach the mandatory retirement age in your organization and are terminated. In this scenario, we can model the certainty of retirement as the furthest time in the future of the CSW, with the knowledge that you could retire sooner or may prefer, but are unable to, retire later.

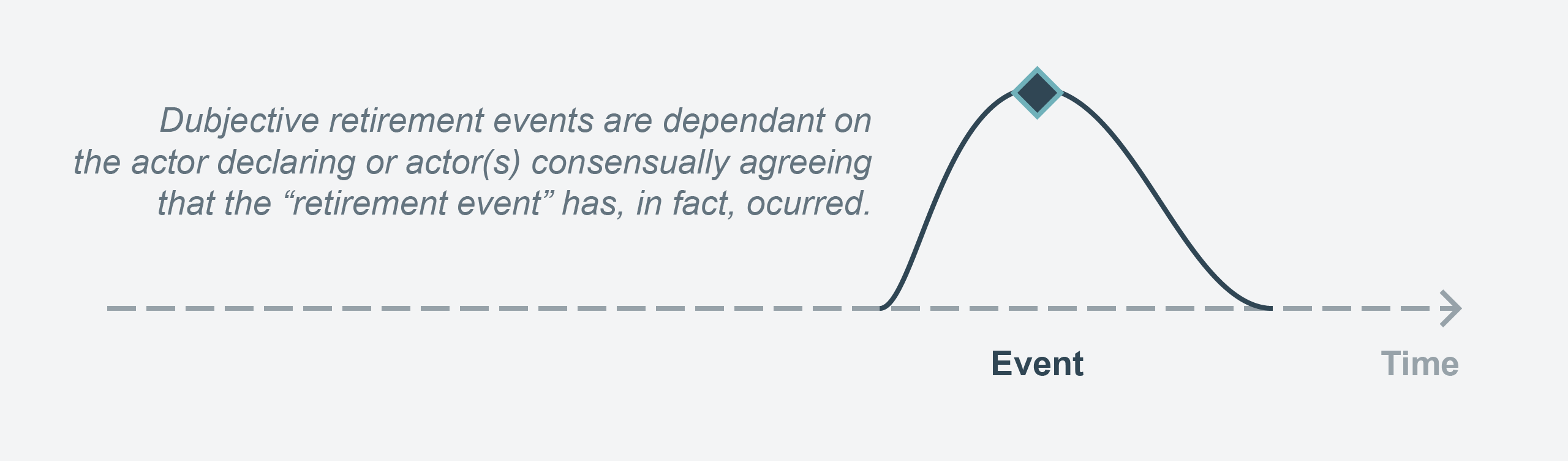

Figure 5: An Objective Event

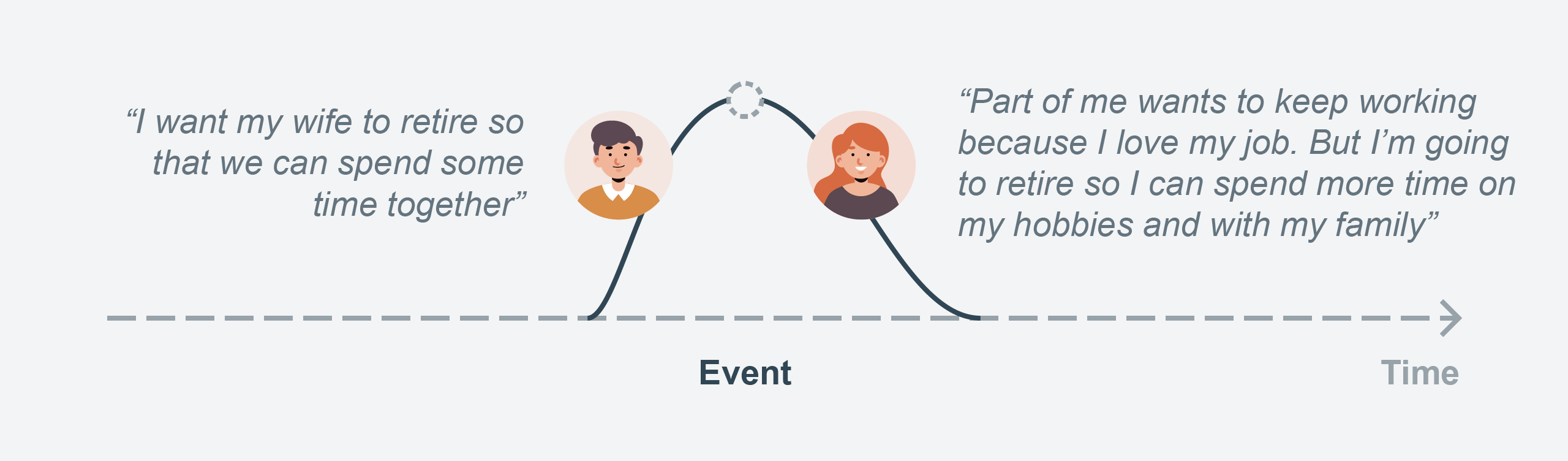

Other retirement events are subjective: you determine the attributes and the criteria that must be met for you to stop working at your current job, and once they are, you retire. Subjective retirement events can be simple, such as choosing to stop working when you are comfortable with the savings you have accumulated, or complex (you, your partner or spouse, and possibly others, such as your children, have different needs, interests, and goals and therefore collectively influence ‘when’ retirement occurs), all, by definition, with the broader CSW that captures the range of time associated with retirement.

Figure 6: A Subjective Event

If there are multiple actors, these attributes may or may not be shared, since each may believe the event has occurred for any number of different privately held or openly shared reasons. For example, a husband and wife may agree on the timing of the wife’s retirement event even if they differ in their motivations for their agreement.

When a Window Collapses

The Proactive Action Strategy (PAS) defines the actor’s approach to maximizing upside potential and minimizing downside risks associated with a CSW. The PAS is interdependent with the CSW, as actions taken can adjust the window, and the window’s adjustments may affect future plans, decisions, and actions.

A window that slides sooner/forward in time may motivate us to update our strategy and/or implement our action plan sooner in time. A window that slides later/backward may similarly motivate changes to our strategy or plan. In both cases, we assume that we are able to plan for and benefit from the event.

A window can be said to collapse when the only remaining actions an actor can take to prepare for an event focus on minimizing adverse outcomes should the event occur. A collapse can be due to a change in the probability curve. Typically, this happens when actors have failed to implement a Proactive Action Strategy and action plan, or they’ve simply chosen to ignore the negative consequences of the CSW. In either case, the actor ignored the potential gains and/or losses that were coupled to the CSW. Disregarding the opportunities and risks associated with a CSW leaves the actor with the best of the worst options rather than the best of the best ones that would have led to a better outcome. In extreme cases, all positive options can evaporate.

For example, suppose a company with a charismatic CEO nearing retirement fails to implement a robust succession plan. Eventually, the opportunity to prepare for the CEOs departure will eventually collapse. And, if the CEO were to announce an unexpectedly early retirement, the window would also collapse. In both of these cases, the most favorable options evaporate. The only remaining options are net-negative.

A window may also collapse due to unforeseen factors, such as a natural disaster or a disruptive technology that upends an industry. In these cases, identifying the CSW, developing a proactive action strategy, and implementing an action plan helps the organization prepare for and respond to the event. Instead of being completely unprepared, the organization may accelerate one or more aspects of a longer-running plan, creating a better long-term outcome.

Of course, not every sliding of a window or a change in probabilities results in collapse. If you’re lucky enough to win the lottery, go ahead and retire early!

But as long as a window has not collapsed, there is still opportunity to maximize the potential for more positive outcomes and neutralize or at least reduce the risks associated with an untimely collapse.

In a Nutshell: Collapsing Sliding Windows

In summary, Collapsing Sliding Windows have the following characteristics:

- The event’s occurrence is not known precisely in advance and is captured through a probability curve that defines its likely occurrence.

- The probability curve that describes the likely occurrence of the event might “slide”— that is, shift earlier or further in time from the curve’s original estimate. These shifts may be based on changes in the environment and by the actions taken by (or inactions of) actors within and outside the organization.

- Objective events occur independently of the actors they impact. Subjective events are typically characterized by multiple attributes or factors considered after the fact to assert that the event has, in fact, happened.

- The event itself is not intrinsically positive or negative—it is factual. It is our relationship to the event and their implications that determine the event’s effect on us and our organizations.

The value of embracing the CSW planning construct is its ability to help leaders identify, plan for, and ultimately respond to events that are likely to have undesirable outcomes if not intentionally and proactively managed. That is, unless a leader develops a strategy and takes planful action to put into practice, their opportunities to manage the event (i.e., solve the problem or capitalize on the opportunity) will typically become more challenging, complex, and costly as time progresses.

While a given event might not occur, implementing an action plan typically has both a positive effect and a low opportunity cost, making the identification and evaluation of CSWs a useful planning construct.

Moreover, depending on the nature of the event, some action plans may actually alter the probability of the event’s occurrence, giving actors more agency over their future. And these characteristics can be leveraged to create competitive advantage through the techniques we describe below.

Collapsing Sliding Windows Surround Us

Collapsing Sliding Windows are everywhere in both our personal and professional lives. Since we explored how CSWs work in our personal lives (the retirement examples), we will now concentrate on examples from business. Note that each of these events begin as opportunities…until they aren’t.

- Leadership succession. We know that senior leaders will eventually leave our organization. Accordingly, succession planning should be captured as a Collapsing Sliding Window.

- Pending or anticipated legislation. Most regulatory bodies provide notice of pending or anticipated legislation that can be captured as a Collapsing Sliding Window.

- Changing suppliers. While many organizations strive to establish long-term relationships with key suppliers, there are often reasons to change them. This desire can be captured as a Collapsing Sliding Window, providing the organization with the planning opportunities needed to implement a smooth and successful transition. In this scenario in particular, the organization probably has some control over sliding the window into a timeframe that’s advantageous to the organization.

- Launching a novel product. The launch of a novel product, especially one that’s physical, can be captured through a Collapsing Sliding Window. Note that if the launch window slides, so should marketing, sales, and any other dependency.

- A competitor beating you to an opportunity. This is out of your control, but how you respond to it isn’t. Consider Apple smart watches vs. Samsung watches, a situation when being first seemed to really matter. Samsung got the watch to market first, but Apple had a better overall strategy for engaging consumers, so they ultimately launched a more successful product. Apple’s window didn’t collapse.

- Mergers, acquisitions, and divestitures. M&A activities can also be captured as a collapsing sliding window, since during the process there are a significant number of events that can materially change the likelihood of a transaction and its near and long-term value to the buyer and seller.

The examples listed above rarely occur in isolation. In real life, CWSs tend to show up in clusters and overlap. So, to determine which windows deserve our attention and in what order, we must be clear about the relative impact of each window and the likelihood of the event’s occurrence. It’s all about priorities.

Collapsing Sliding Windows in business are not only associated with large companies. Two of the most common CSWs in startups include raising capital/funding, and exits (such as being acquired or going public); in both cases, the specific timing of the event is uncertain.

Collapsing Sliding Windows provides a new way to assess future events. Once you become comfortable using them, you will undoubtedly find more examples of them in your personal and professional lives.

How to Plan for and Monitor CSWs:A Temporal Readiness System

“No one can anticipate everything that might happen. Sensing possibilities, though, is better than having no sense at all of what to expect.”

— John Lewis Gaddis, On Grand Strategy

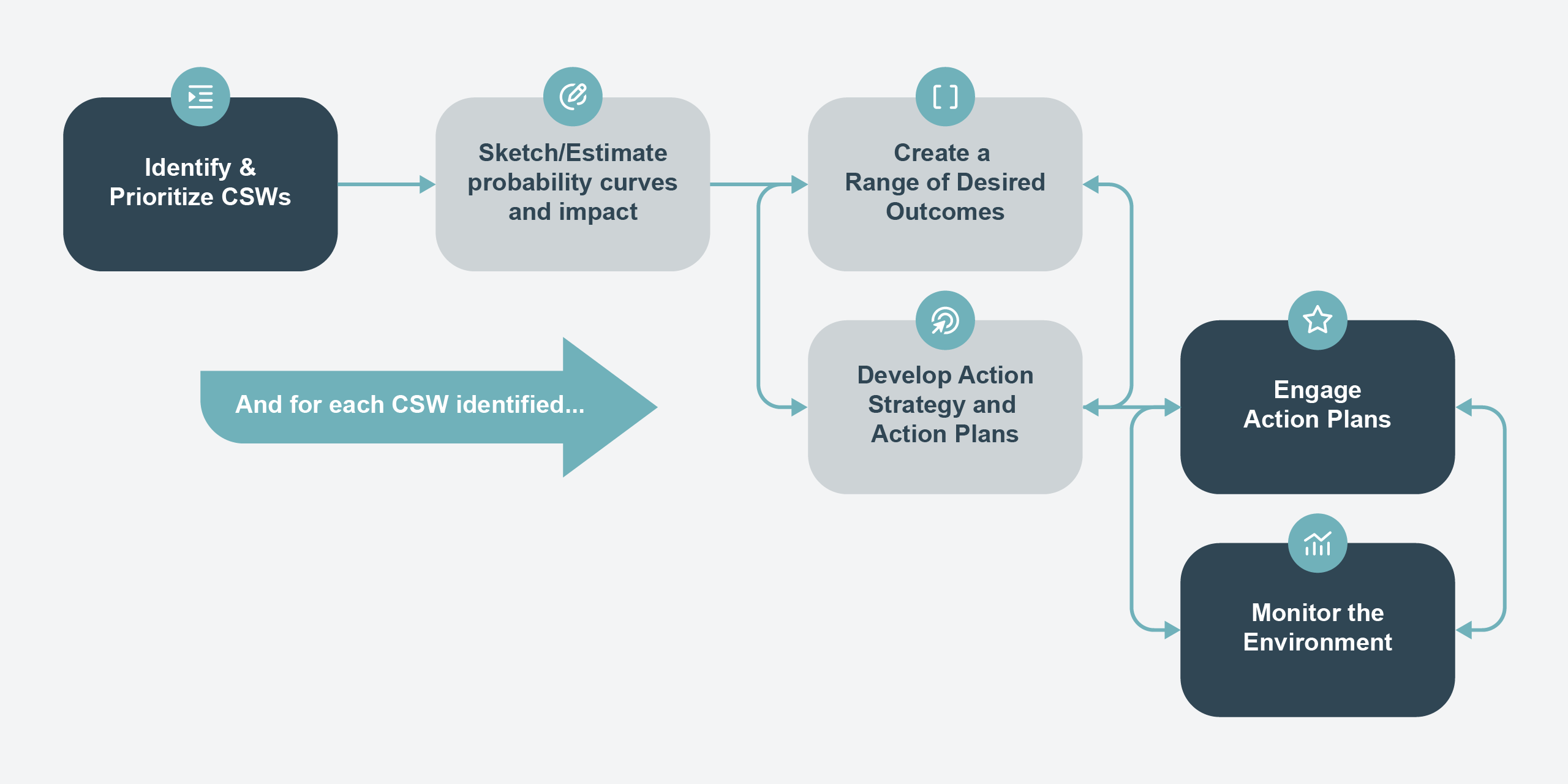

To help individuals and organizations visualize the CSW process, we created a graphic showing each of its steps:

Let’s go over them one by one.

-

Identify CSWs

While we are surrounded by Collapsing Sliding Windows, it is ill-advised to try and identify all possible events and windows. We’ll become overwhelmed and potentially discouraged.

Instead of trying to identify every possible CSW, focus your attention on those that are likely to materially impact you, your stakeholders, and/or your business. In addition to the examples we presented earlier, here are some business-centric events that may be relevant when captured as CSWs:

- Technological breakthroughs, such as AI or Quantum computing

- Industry transformation, such as the aggregate changes that occur with new paradigms (example: instead of relying on parts-replacement inventories, a company converts to Additive Manufacturing (AM) employing 3D printing

- Pending legislation

- Demographic shifts that result in “tipping points,” such as AI

- Geopolitical events

In our experience, it will typically take a group of executives less than an hour to identify potential events that can be framed as CSWs.

If you need help identifying potential events that are likely to be relevant, we advocate applying the STARS Model of Business Evolution, described by Michael D. Watkins in his book The First 90 Days: Critical Success Strategies for New Leaders at All Levels.[1]

In the book, Watkins argues that businesses go through five stages of evolution:

- Startup phase

- Turnaround phase, a state where, if nothing is done, the business will collapse and/or go bankrupt

- Accelerated growth, when companies are growing super-fast, sometimes more than management can handle

- Realignment, what happens when businesses derail from the right trajectory and now need to adjust course (realign) to move forward and be successful

- Sustaining success, his term for businesses that are doing pretty well but are at risk of becoming overconfident and overlooking key information or strategies

Using this STARS taxonomy as a guide, we can seek out CSWs that can create the greatest beneficial impact for our organization. For example, startups are unlikely to benefit from strongly considering succession planning, while organizations focused on sustaining success are unlikely to benefit from worrying about changing suppliers—unless doing so will help the business materially improve.

-

Sketch/Estimate Probability Curves and Impact

In this next step, actors affected by the event estimate the probability curve and impact of the event.

The recommended approach to establishing the probability curve is to assemble a group of leaders and ask each of them to draw their own timeline and probability curve. Once the curves have been drawn, each person should explain their curve, including its attributes; how the curve may be impacted by events; and most importantly, the expected positive, unknown, or negative impacts of the event based on when it might occur.

Here are some questions to help prompt participants:

- Range and shape: What is the expected range and shape of the curve? Is there an actual window or is the event characterized by an ever-receding horizon?

- Attributes: What attributes are most material? What degree of control does the group have over these attributes? Which attributes are objective, and which are subjective?

- Impact: What is the most compelling reason to do something? In other words, what is the expected effect or impact of the event? What might cause this to change? For example, a startup that fails to adequately prepare for a funding event (typically a positive thing for a growing company) would likely change the funding event from a favorable valuation (a positive outcome) to a low valuation or a down round (a negative outcome).

- Action timing: What is the “last responsible moment” of action, beyond which taking action becomes significantly harder or more costly?

- Implications of an early collapse: What might happen if the business delays in preparing for the event?

The results of this step should be simple illustrations with statements, such as:

- “Based on our current growth and burn rate, we’ll need a $4M–$6M Series A funding event in late Q3 and before the end of the year. If we fail to raise at least $3M, we’ll need to significantly reduce expenses.”

- “Our payments processor cannot meet the data privacy laws of our planned global expansion, so we’ll need to find a new processor sometime in the first half of next year.”

As you consider the probability curves, attributes, and event, you will also identify specific actions that you could take to alter how the event unfolds and/or its default effects. Capture these and put them aside. We'll use them later.

Additionally, as you develop your understanding of the event’s impact, you may find that you change your mind about the event’s desirability. For instance, perhaps the likely economic impact of the event is immaterial, or the subjective evaluation of the event’s outcomes indicates that other events are more important. These are all useful insights, as they enable you to ignore the noise of the many potential future events that surround you and focus on those events and outcomes that are worthy of inclusion in your Proactive Action Strategy process and its associated plan.

-

Create a Range of Desired Outcomes

Identifying and evaluating the impact(s) of the event helps us grasp the range of desired outcomes that may result from it. Additionally, this process can help us identify which set of suitable actions we should take to proactively influence the outcome in our favor.

In this step, then, you will formally articulate potential event outcomes to inform and guide your Proactive Action Strategy (PAS). You will also assess the nature and degree of investment you need to achieve your preferred or desired outcomes within the timeframe of the event’s CSW.

To continue with our earlier startup-funding example: as founders contemplate the undesirable impact of being diluted based on equity funding, they are likely to explore other forms of raising capital that impact their equity in different ways. For instance, seeking organic growth, raising prices, customer funding, and debt financing are alternative means of raising capital that do not result in equity dilution.

However, each of these alternatives introduces a different set of considerations and constraints that must be considered. A founder may have to personally guarantee debt financing, creating undue personal risk. While customer funding may preserve equity, it is likely to limit the ability for founders to pursue substantial changes in their product’s capabilities. Raising prices or limiting growth might cause customers to defect to competitors.

This suggests that each CSW has a set of common and unique attributes that must be considered. In the case of funding, these include equity and dilution, access to capital sources, timing, size of the investment, restrictions, and obligations.

Understanding the range of outcomes is especially important when longer time horizons are at play, as we tend to underestimate what we can accomplish over a long period of time and overestimate what we can accomplish in a shorter one. While this is most apparent in financial analyses in which compounding benefits create a non-linear outcome curve, we can see this phenomenon play out in non-financial-oriented CSWs as well. For example, committing to a succession planning program for senior executives is likely to provide numerous advantages, including:

- A reduction in the chances of derailment or subordinate talent attrition

- An increase in the company’s chances of identifying high-potential leaders, through the use of assessments and situational simulations to evaluate and acclimate them to potential challenges

- The creation of shared bodies of knowledge through training programs for said high-potential leaders

- Clarification of the complexity of the types of decisions and challenges new leaders will face, enabling them to distribute work and be more effective

- Improved consistency in managing the workforce, creating greater and more fairly distributed opportunities

- Sustained organizational culture by aligning new positional power with behavior

Express potential desired outcomes by establishing a spectrum of success that aligns with various objective and subjective evaluations, from sufficient to ideal. For example, it can be unrealistic for a 55-year-old who’s seeking to retire between 60 and 62 to expect that they can do so by purchasing a winning lottery ticket, or for a company that is experiencing hypergrowth to expect they can succeed without equity funding, as hypergrowth typically consumes cash faster than most other kinds of funding can support.

Additionally, responding to the following targeted question prompts can make the decision-making process even more effective:[2]

- What’s wanted? Provide a succinct statement that articulates the surface-level “want” or need.

- Why is it wanted or needed? What’s the deeper psychological motivation behind the want(s) or to address the unmet need?

- What are the criteria for success? A combination of hard and soft attributes, this information provides clarity on what, theoretically, would be true once the “event” has occurred. It is ideally expressed as ranges, as they help manage the nature and structure of the CSW.

- What are the potential unintended negative consequences? This information will help ensure you manage expectations (or ways to mitigate harm), enabling you to more fully prepare for the event and its outcome.

Because not every actor will be interested in the event or its possible outcomes, you can also obtain useful insights by identifying stakeholders who seek different or conflicting desired outcomes, or might even be working against them in some way or another.

As you consider the set of potential outcomes, remain aware of the dynamic nature of CSWs: what might be deemed acceptable by an actor or team of actors may change over time (“Our team was initially willing to accept a buyout offer of $48M. However, our continued growth and increasing profitability means that we’re now asking for $65M.”)

-

Develop Proactive Action Strategy and Action Plan

For CSWs that capture material outcomes, the next step is to develop a Proactive Action Strategy (“the how”) and a Proactive Action Plan (“the what”).

Your Proactive Action Strategy dictates the general approach you will take to manage a CSW. Here are a few examples of what this looks like.

- If the CSW is associated with an event that costs money, such as building a new product or service, a wedding, or a retirement, you will have to use a strategy that facilitates acquiring the necessary funds.

In the business world, this may involve such things as reserving funds in a future budget cycle, raising funds through a public offering, or selling receivables, or taking a loan.

In our personal lives, we may instead opt for a saving/investing strategy with a focus on financial compounding. - If the CSW requires an investment to preserve a future right, consider using real options.

- If the CSW is associated with an event that creates money, such as the sale of an asset, the action strategy may simply be focused on maintaining the value of the asset.

- If the CSW is primarily behavioral, such as adjusting existing operating procedures in advance of new regulations, the strategy is likely to start by focusing on when it is most advantageous to adjust behaviors, followed by an assessment of which specific behaviors to change.

An effective Proactive Action Strategy helps you create your Proactive Action Plan (PAP), a planned sequence of actions that are collectively designed to enable you to leverage the CSW. A PAS is meant to be more general, while a PAP must be specific to and actionable to be effective.

For example, CSWs that benefit from compounding will have a PAP that defines investment amounts and timings along with Monte Carlo-based financial models that help you determine if you’re on track. CSWs that benefit from real option investment strategies will have a different PAP and different models.

The strategy will also help you determine when you need to implement the plan. Suppose, for example, you have developed CSWs for events like buying a home, getting married, or retiring. Your age and other factors will determine which strategies you choose and when you will engage the action plans associated with these strategies.

Once you develop your Proactive Action Plan, the next steps are to implement the plan and monitor the environment.

Developing more than one PAS

A Proactive Action Strategy typically assumes the focus is on a primary proactive response. However, a more robust strategy will also take into consideration additional potential responses. One way to do this is to employ the U.S. Military’s PACE model, created for high-stakes and emergency-response resilience and redundancy planning:

- Primary: the preferred method of communication or operation, used under normal circumstances.

- Alternate: the backup plan, activated when the primary method is unavailable or compromised.

- Contingency: a plan for dealing with unexpected situations that could significantly disrupt the primary or alternate plans.

- Emergency: the most extreme plan, designed for catastrophic scenarios where all other options are exhausted.

While each of these strategies could theoretically be successful, your subjective evaluation of each can be used to assess their viability, i.e., how likely they are to produce the desired outcome. For example, you may find that the subjective desirability of a given outcome changes if implementing a specific PAS is deemed too difficult.

When crafting a PAP using the PACE model, you gain flexibility. Let’s return to our example of startup funding:

- Primary plan: Secure a $6M Series A by Q3 from a lead investor already in your network.

- Alternate plan: Raise a $3M bridge round from existing investors.

- Contingency plan: Pursue strategic partnerships or early customer revenue to extend the runway.

- Emergency plan: Execute a structured wind-down, preserving IP and offering soft landings for employees.

Each tier of your strategy should align with your stakeholders’ expectations and organizational values. The more prepared you are across these tiers, the more resilient your organization becomes when the window starts to shift or collapse.

Subjective evaluations of each strategy also inform readiness. For example, a founder might view the Emergency plan as personally unacceptable, even if rationally necessary. Surfacing and naming these reactions improves decision quality.

The PACE approach doesn’t just create redundancy—it creates agility.

Designing favorable PAS interactions

Multiple windows → Multiple PAS

As you implement the strategies we’ve just laid out and the actions they prompt, strive to avoid conflicts and optimize the whole. This may not be possible, so some actions may inevitably be antagonistic. In this kind of case, treating the event as a “wicked problem” and pursuing multiple actions may be your best choice.

Consider any example in which a company is pursuing a primary course of action (A) while also believing that an alternative (B) will emerge to take over (A) even though (B) is not yet obvious. A classic example in the tech world was IBM with OS/2, MS-DOS, and AS/400 computer operating systems.

- If the CSW is associated with an event that costs money, such as building a new product or service, a wedding, or a retirement, you will have to use a strategy that facilitates acquiring the necessary funds.

-

Engage Action Plans

A critical part of your PAP is deciding when it should be employed. In a compounding situation, the math is easy: simply starting sooner, even with small amounts of money, is the best financial option.

However, not all CSWs should be subjected to purely financial criteria. For example, elite athletes often delay school and “normal jobs” when they are younger, secure in the knowledge that they can go to school and take a “normal job” after they age out of elite competition.

Similarly, a startup may forego succession planning to focus on the growth of their business. More generally, because not all CSWs benefit from compounding, your PAS may need to embrace decisions and actions that make it challenging or impossible to reap the (non-linear) rewards of compounding.

-

Monitor the Environment

To be clear, starting sooner doesn’t mean you will use a different PAS. It’s not time contingent; your plan should still be to activate/employ the PAS you’ve developed.

But once you begin, the clock starts ticking. And when it does, the most effective way to reduce the chance of being surprised by an untimely collapse is to monitor the context or environment.

Monitoring doesn’t require a control tower. It requires rhythm.

Establishing a cadence for environmental scanning—whether monthly, quarterly, or at the outset of any new event—helps organizations using CSWs stay ahead of emerging risks and opportunities. Think of this as lightweight scenario sensing: revisiting the probability curve, assessing whether key assumptions still hold, and determining whether trigger conditions for activating your PAS are being met.

Key indicators to monitor may include:

- External signals (e.g., macroeconomic shifts, policy updates, competitive moves)

- Internal signals (e.g., burn rate, team capacity, engagement metrics)

- Stakeholder sentiment (both explicit and inferred)

- How the CSW might be changing based on your actions (e.g., preparing for a change in Suppliers might motivate a current Supplier to better meet your needs, changing your strategy)

When patterns shift, so must your strategy. Recalibration is a strength, not a failure. Building this flexibility into your operating model reinforces strategic foresight and strengthens execution.

-

Failure Patterns / What to Avoid

The power of the CSW framework lies in its ability to convert uncertainty or vague pronouncements about the future into a proactive planning process. But like any tool, it can be misused or ignored. Here are key failure patterns to watch for:

- Wishful thinking: assuming the best-case scenario captured in a CSW will happen without backing that belief up with a proactive action plan (PAP). This often shows up as “strategy by hope” or magical / silver-bullet thinking.

- Willful ignorance: deliberately ignoring early indicators that a window may be shifting or collapsing. This often includes suppressing uncomfortable conversations or delaying critical analysis.

- Big bang planning: waiting too long and then trying to compensate for the collapse of the window by compressing all the necessary actions into a single, massive effort. It rarely works and often results in wasted resources or organizational whiplash.

- Confusing busywork with strategy: going through the motions of planning but failing to translate that into meaningful progress on a PAS.

- Neglecting subjectivity: dismissing the emotional and political dimensions of a CSW. Decisions are not purely rational, and overlooking this truth often results in misalignment or passive resistance. To overcome this, encourage executives to draw their curves individually and compare them as a team.

The good news? These failure patterns are avoidable.

While we are surrounded by Collapsing Sliding Windows, it is ill-advised to try and identify all possible events and windows. We’ll become overwhelmed and potentially discouraged.

Instead of trying to identify every possible CSW, focus your attention on those that are likely to materially impact you, your stakeholders, and/or your business. In addition to the examples we presented earlier, here are some business-centric events that may be relevant when captured as CSWs:

- Technological breakthroughs, such as AI or Quantum computing

- Industry transformation, such as the aggregate changes that occur with new paradigms (example: instead of relying on parts-replacement inventories, a company converts to Additive Manufacturing (AM) employing 3D printing

- Pending legislation

- Demographic shifts that result in “tipping points,” such as AI

- Geopolitical events

In our experience, it will typically take a group of executives less than an hour to identify potential events that can be framed as CSWs.

If you need help identifying potential events that are likely to be relevant, we advocate applying the STARS Model of Business Evolution, described by Michael D. Watkins in his book The First 90 Days: Critical Success Strategies for New Leaders at All Levels.[1]

In the book, Watkins argues that businesses go through five stages of evolution:

- Startup phase

- Turnaround phase, a state where, if nothing is done, the business will collapse and/or go bankrupt

- Accelerated growth, when companies are growing super-fast, sometimes more than management can handle

- Realignment, what happens when businesses derail from the right trajectory and now need to adjust course (realign) to move forward and be successful

- Sustaining success, his term for businesses that are doing pretty well but are at risk of becoming overconfident and overlooking key information or strategies

Using this STARS taxonomy as a guide, we can seek out CSWs that can create the greatest beneficial impact for our organization. For example, startups are unlikely to benefit from strongly considering succession planning, while organizations focused on sustaining success are unlikely to benefit from worrying about changing suppliers—unless doing so will help the business materially improve.

In this next step, actors affected by the event estimate the probability curve and impact of the event.

The recommended approach to establishing the probability curve is to assemble a group of leaders and ask each of them to draw their own timeline and probability curve. Once the curves have been drawn, each person should explain their curve, including its attributes; how the curve may be impacted by events; and most importantly, the expected positive, unknown, or negative impacts of the event based on when it might occur.

Here are some questions to help prompt participants:

- Range and shape: What is the expected range and shape of the curve? Is there an actual window or is the event characterized by an ever-receding horizon?

- Attributes: What attributes are most material? What degree of control does the group have over these attributes? Which attributes are objective, and which are subjective?

- Impact: What is the most compelling reason to do something? In other words, what is the expected effect or impact of the event? What might cause this to change? For example, a startup that fails to adequately prepare for a funding event (typically a positive thing for a growing company) would likely change the funding event from a favorable valuation (a positive outcome) to a low valuation or a down round (a negative outcome).

- Action timing: What is the “last responsible moment” of action, beyond which taking action becomes significantly harder or more costly?

- Implications of an early collapse: What might happen if the business delays in preparing for the event?

The results of this step should be simple illustrations with statements, such as:

- “Based on our current growth and burn rate, we’ll need a $4M–$6M Series A funding event in late Q3 and before the end of the year. If we fail to raise at least $3M, we’ll need to significantly reduce expenses.”

- “Our payments processor cannot meet the data privacy laws of our planned global expansion, so we’ll need to find a new processor sometime in the first half of next year.”

As you consider the probability curves, attributes, and event, you will also identify specific actions that you could take to alter how the event unfolds and/or its default effects. Capture these and put them aside. We'll use them later.

Additionally, as you develop your understanding of the event’s impact, you may find that you change your mind about the event’s desirability. For instance, perhaps the likely economic impact of the event is immaterial, or the subjective evaluation of the event’s outcomes indicates that other events are more important. These are all useful insights, as they enable you to ignore the noise of the many potential future events that surround you and focus on those events and outcomes that are worthy of inclusion in your Proactive Action Strategy process and its associated plan.

Identifying and evaluating the impact(s) of the event helps us grasp the range of desired outcomes that may result from it. Additionally, this process can help us identify which set of suitable actions we should take to proactively influence the outcome in our favor.

In this step, then, you will formally articulate potential event outcomes to inform and guide your Proactive Action Strategy (PAS). You will also assess the nature and degree of investment you need to achieve your preferred or desired outcomes within the timeframe of the event’s CSW.

To continue with our earlier startup-funding example: as founders contemplate the undesirable impact of being diluted based on equity funding, they are likely to explore other forms of raising capital that impact their equity in different ways. For instance, seeking organic growth, raising prices, customer funding, and debt financing are alternative means of raising capital that do not result in equity dilution.

However, each of these alternatives introduces a different set of considerations and constraints that must be considered. A founder may have to personally guarantee debt financing, creating undue personal risk. While customer funding may preserve equity, it is likely to limit the ability for founders to pursue substantial changes in their product’s capabilities. Raising prices or limiting growth might cause customers to defect to competitors.

This suggests that each CSW has a set of common and unique attributes that must be considered. In the case of funding, these include equity and dilution, access to capital sources, timing, size of the investment, restrictions, and obligations.

Understanding the range of outcomes is especially important when longer time horizons are at play, as we tend to underestimate what we can accomplish over a long period of time and overestimate what we can accomplish in a shorter one. While this is most apparent in financial analyses in which compounding benefits create a non-linear outcome curve, we can see this phenomenon play out in non-financial-oriented CSWs as well. For example, committing to a succession planning program for senior executives is likely to provide numerous advantages, including:

- A reduction in the chances of derailment or subordinate talent attrition

- An increase in the company’s chances of identifying high-potential leaders, through the use of assessments and situational simulations to evaluate and acclimate them to potential challenges

- The creation of shared bodies of knowledge through training programs for said high-potential leaders

- Clarification of the complexity of the types of decisions and challenges new leaders will face, enabling them to distribute work and be more effective

- Improved consistency in managing the workforce, creating greater and more fairly distributed opportunities

- Sustained organizational culture by aligning new positional power with behavior

Express potential desired outcomes by establishing a spectrum of success that aligns with various objective and subjective evaluations, from sufficient to ideal. For example, it can be unrealistic for a 55-year-old who’s seeking to retire between 60 and 62 to expect that they can do so by purchasing a winning lottery ticket, or for a company that is experiencing hypergrowth to expect they can succeed without equity funding, as hypergrowth typically consumes cash faster than most other kinds of funding can support.

Additionally, responding to the following targeted question prompts can make the decision-making process even more effective:[2]

- What’s wanted? Provide a succinct statement that articulates the surface-level “want” or need.

- Why is it wanted or needed? What’s the deeper psychological motivation behind the want(s) or to address the unmet need?

- What are the criteria for success? A combination of hard and soft attributes, this information provides clarity on what, theoretically, would be true once the “event” has occurred. It is ideally expressed as ranges, as they help manage the nature and structure of the CSW.

- What are the potential unintended negative consequences? This information will help ensure you manage expectations (or ways to mitigate harm), enabling you to more fully prepare for the event and its outcome.

Because not every actor will be interested in the event or its possible outcomes, you can also obtain useful insights by identifying stakeholders who seek different or conflicting desired outcomes, or might even be working against them in some way or another.

As you consider the set of potential outcomes, remain aware of the dynamic nature of CSWs: what might be deemed acceptable by an actor or team of actors may change over time (“Our team was initially willing to accept a buyout offer of $48M. However, our continued growth and increasing profitability means that we’re now asking for $65M.”)

For CSWs that capture material outcomes, the next step is to develop a Proactive Action Strategy (“the how”) and a Proactive Action Plan (“the what”).

Your Proactive Action Strategy dictates the general approach you will take to manage a CSW. Here are a few examples of what this looks like.

- If the CSW is associated with an event that costs money, such as building a new product or service, a wedding, or a retirement, you will have to use a strategy that facilitates acquiring the necessary funds.

In the business world, this may involve such things as reserving funds in a future budget cycle, raising funds through a public offering, or selling receivables, or taking a loan.

In our personal lives, we may instead opt for a saving/investing strategy with a focus on financial compounding. - If the CSW requires an investment to preserve a future right, consider using real options.

- If the CSW is associated with an event that creates money, such as the sale of an asset, the action strategy may simply be focused on maintaining the value of the asset.

- If the CSW is primarily behavioral, such as adjusting existing operating procedures in advance of new regulations, the strategy is likely to start by focusing on when it is most advantageous to adjust behaviors, followed by an assessment of which specific behaviors to change.

An effective Proactive Action Strategy helps you create your Proactive Action Plan (PAP), a planned sequence of actions that are collectively designed to enable you to leverage the CSW. A PAS is meant to be more general, while a PAP must be specific to and actionable to be effective.

For example, CSWs that benefit from compounding will have a PAP that defines investment amounts and timings along with Monte Carlo-based financial models that help you determine if you’re on track. CSWs that benefit from real option investment strategies will have a different PAP and different models.

The strategy will also help you determine when you need to implement the plan. Suppose, for example, you have developed CSWs for events like buying a home, getting married, or retiring. Your age and other factors will determine which strategies you choose and when you will engage the action plans associated with these strategies.

Once you develop your Proactive Action Plan, the next steps are to implement the plan and monitor the environment.

Developing more than one PAS

A Proactive Action Strategy typically assumes the focus is on a primary proactive response. However, a more robust strategy will also take into consideration additional potential responses. One way to do this is to employ the U.S. Military’s PACE model, created for high-stakes and emergency-response resilience and redundancy planning:

- Primary: the preferred method of communication or operation, used under normal circumstances.

- Alternate: the backup plan, activated when the primary method is unavailable or compromised.

- Contingency: a plan for dealing with unexpected situations that could significantly disrupt the primary or alternate plans.

- Emergency: the most extreme plan, designed for catastrophic scenarios where all other options are exhausted.

While each of these strategies could theoretically be successful, your subjective evaluation of each can be used to assess their viability, i.e., how likely they are to produce the desired outcome. For example, you may find that the subjective desirability of a given outcome changes if implementing a specific PAS is deemed too difficult.

When crafting a PAP using the PACE model, you gain flexibility. Let’s return to our example of startup funding:

- Primary plan: Secure a $6M Series A by Q3 from a lead investor already in your network.

- Alternate plan: Raise a $3M bridge round from existing investors.

- Contingency plan: Pursue strategic partnerships or early customer revenue to extend the runway.

- Emergency plan: Execute a structured wind-down, preserving IP and offering soft landings for employees.

Each tier of your strategy should align with your stakeholders’ expectations and organizational values. The more prepared you are across these tiers, the more resilient your organization becomes when the window starts to shift or collapse.

Subjective evaluations of each strategy also inform readiness. For example, a founder might view the Emergency plan as personally unacceptable, even if rationally necessary. Surfacing and naming these reactions improves decision quality.

The PACE approach doesn’t just create redundancy—it creates agility.

Designing favorable PAS interactions

Multiple windows → Multiple PAS

As you implement the strategies we’ve just laid out and the actions they prompt, strive to avoid conflicts and optimize the whole. This may not be possible, so some actions may inevitably be antagonistic. In this kind of case, treating the event as a “wicked problem” and pursuing multiple actions may be your best choice.

Consider any example in which a company is pursuing a primary course of action (A) while also believing that an alternative (B) will emerge to take over (A) even though (B) is not yet obvious. A classic example in the tech world was IBM with OS/2, MS-DOS, and AS/400 computer operating systems.

A critical part of your PAP is deciding when it should be employed. In a compounding situation, the math is easy: simply starting sooner, even with small amounts of money, is the best financial option.

However, not all CSWs should be subjected to purely financial criteria. For example, elite athletes often delay school and “normal jobs” when they are younger, secure in the knowledge that they can go to school and take a “normal job” after they age out of elite competition.

Similarly, a startup may forego succession planning to focus on the growth of their business. More generally, because not all CSWs benefit from compounding, your PAS may need to embrace decisions and actions that make it challenging or impossible to reap the (non-linear) rewards of compounding.

To be clear, starting sooner doesn’t mean you will use a different PAS. It’s not time contingent; your plan should still be to activate/employ the PAS you’ve developed.

But once you begin, the clock starts ticking. And when it does, the most effective way to reduce the chance of being surprised by an untimely collapse is to monitor the context or environment.

Monitoring doesn’t require a control tower. It requires rhythm.

Establishing a cadence for environmental scanning—whether monthly, quarterly, or at the outset of any new event—helps organizations using CSWs stay ahead of emerging risks and opportunities. Think of this as lightweight scenario sensing: revisiting the probability curve, assessing whether key assumptions still hold, and determining whether trigger conditions for activating your PAS are being met.

Key indicators to monitor may include:

- External signals (e.g., macroeconomic shifts, policy updates, competitive moves)

- Internal signals (e.g., burn rate, team capacity, engagement metrics)

- Stakeholder sentiment (both explicit and inferred)

- How the CSW might be changing based on your actions (e.g., preparing for a change in Suppliers might motivate a current Supplier to better meet your needs, changing your strategy)

When patterns shift, so must your strategy. Recalibration is a strength, not a failure. Building this flexibility into your operating model reinforces strategic foresight and strengthens execution.

The power of the CSW framework lies in its ability to convert uncertainty or vague pronouncements about the future into a proactive planning process. But like any tool, it can be misused or ignored. Here are key failure patterns to watch for:

- Wishful thinking: assuming the best-case scenario captured in a CSW will happen without backing that belief up with a proactive action plan (PAP). This often shows up as “strategy by hope” or magical / silver-bullet thinking.

- Willful ignorance: deliberately ignoring early indicators that a window may be shifting or collapsing. This often includes suppressing uncomfortable conversations or delaying critical analysis.

- Big bang planning: waiting too long and then trying to compensate for the collapse of the window by compressing all the necessary actions into a single, massive effort. It rarely works and often results in wasted resources or organizational whiplash.

- Confusing busywork with strategy: going through the motions of planning but failing to translate that into meaningful progress on a PAS.

- Neglecting subjectivity: dismissing the emotional and political dimensions of a CSW. Decisions are not purely rational, and overlooking this truth often results in misalignment or passive resistance. To overcome this, encourage executives to draw their curves individually and compare them as a team.

The good news? These failure patterns are avoidable.

Conclusion

The Collapsing Sliding Windows framework is a powerful tool to help leaders prepare for future events, not by pretending to eliminate uncertainty, but by engaging with it thoughtfully. It allows leaders to navigate the terrain between near-term agility and long-range strategy by integrating probability, timing, and impact into their planning conversations.

The strength of the CSW framework is not in predicting the future, but in preparing for it. By acknowledging that windows slide, narrow, or collapse, we reclaim agency over events that might otherwise take us by surprise. We shift from reactive firefighting to proactive, intentional action.

When adopted with discipline, curiosity, and humility, CSWs enable smarter investments, better timeline control, and greater alignment—within teams, across portfolios, and throughout an entire enterprise. In a business environment increasingly shaped by volatility, uncertainty, complexity, and ambiguity, that may be the most strategic advantage of all.

References

- Michael D. Watkins, The First 90 Days: Critical Success Strategies for New Leaders at All Levels (Harvard Business School Press, 2003).

- Harry Max, Managing Priorities: How to Create Better Plans and Make Smarter Decisions (Two Waves Books, 2024).

Appendix: Related Frameworks and Planning Constructs

While a novel approach, Collapsing Sliding Windows has natural relationships with several existing planning constructs. Understanding how CSW overlaps with these frameworks will help you apply it with greater nuance and better integrate it into your existing strategy practices.

- Real options provides a structured approach to investing designed to create future flexibility. It recognizes that some strategic decisions are best framed as options, not commitments. CSWs and real options are symbiotic: CSW helps surface when and where real options should be created, while real options offer a financial or operational model for managing uncertainty within the window. For example, securing the right to develop a novel hardware solution through investments in patents can be viewed as a real option within a CSW related to forecasted customer needs.

- Scenario planning explores multiple possible futures to test the robustness of strategies. CSW complements this by framing when these scenarios may become real and what actions to take in the lead-up. The probability curve in a CSW helps prioritize which scenarios warrant active monitoring and proactive engagement.

- Rolling wave planning embraces uncertainty by planning in greater detail for near-term work while leaving future work at a higher level. CSW enriches this approach by explicitly identifying windows where uncertainty is highest and where early, light-touch planning can create outsized leverage later. They offer a rationale for when and how to refine future waves.

- Assumptive goal setting recognizes that many strategic objectives are built on underlying assumptions. CSW provides a framework for stress-testing these assumptions over time. When the probability curve of a CSW starts to shift, it often signals that one or more of our assumptions are no longer holding—prompting us to reassess our goals and strategies.

- Decision trees model choices, uncertainties, and payoffs. CSW adds a temporal dimension often absent in decision trees, helping decision makers consider how the value of their choices changes over time, and what they must do before a branch becomes viable or foreclosed.

Taken together, these constructs form a powerful toolkit. CSW isn’t meant to replace them; rather, it provides scaffolding for integrating them into real-time strategic thinking.

The future isn’t just out there—it’s actively approaching. CSW helps us meet it well prepared.

Appendix: Collapsing Sliding Windows and SAFe

The Scaled Agile Framework (SAFe) includes multiple constructs that can be naturally extended to incorporate CSWs. Here are a few:

- PI Roadmaps capture foreseeable events within a 1–3 Planning Interval time horizon. CSWs that manifest within this range are best modeled in the roadmap, where teams can align around short-term execution.

- Solution Roadmaps extend planning further into the future. They are well-suited for CSWs that have a longer but still tangible timeframe (e.g., a compliance mandate expected within 36 months). Adding CSWs to Solution Roadmaps is particularly useful for organizations experiencing high rates of growth or operating in extremely volatile environments, since they help leaders deal with frequently changing probability curves.

- Epics, particularly those that require significant investment, are ideal vehicles to fund exploration or mitigation strategies for CSWs. Extending the Lean Business Case to include CSW-specific elements (notably, probability curves and proactive action strategies) supports members of the LPM team in making portfolio investments.

- Solutions by Horizon can be correlated with CSWs to help organizations prepare for the transition of solutions between horizons.

- Architectural Runway is involved when the Proactive Action Strategy involves technical enablers. For instance, beginning a gradual migration to cloud infrastructure in anticipation of significant growth in usage leaves the organization prepared if the usage materializes faster than expected.

The unique planning feature of CSWs is that they allow organizations using SAFe to plan for events beyond the canonical time horizons defined in SAFe. For example, CSWs are well-suited to time horizons of 5, 10, 20, or even 40 years.

The point is not to bolt CSWs onto SAFe, but to let CSWs inform and enrich the strategic and budgeting mechanisms already present in SAFe. In a world of increasing uncertainty, CSWs give SAFe practitioners a way to lean into the unknown while retaining organizational agility.

About the Authors

|

|

|